To attract and convert customers for your business, it’s important to understand how they think about the price of your offering.

There are lots of factors around price that influence a customer’s decision to make a purchase. Some of those factors are functional (e.g. how much money do I have available?) and some are emotional (e.g. do I trust this brand?).

In the end, those factors get blended together and compared against the price of your product or service. If the customer’s internal calculation matches favorably with your price, you get a “yes”. If not, then you get a “no”.

The problem is that not every “yes” or “no” is created equal. If we only focus on that final answer, we wipe away the subtle ingredients that influenced the decision.

How can we pull that decision apart and learn how a “no” might get nudged to a “yes”? And what insights can we get from a “yes” to try and find more of them?

By clarifying these ideas, we can improve how we invest our time, energy, and money to attract customers. It may also uncover a need for changes to your price or offering for specific customer segments.

Customer Price Map Exercise

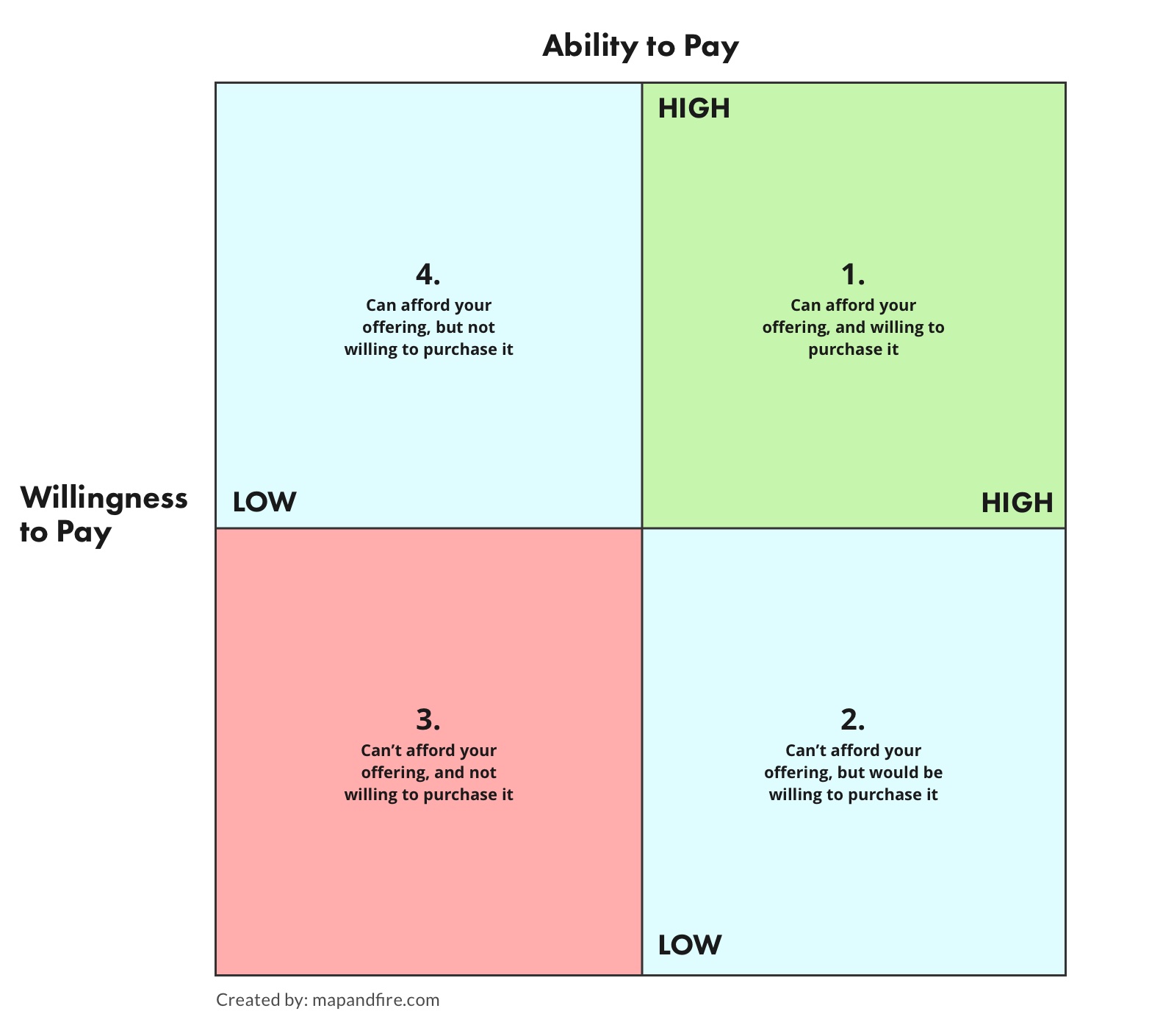

In the following exercise, there are the two overarching criteria we’ll use to evaluate your customers:

Ability to Pay (ATP)

For this exercise, we can think of this as the means a customer has to purchase your offering. This takes into account practical factors like a customer’s income, earning potential, investments, or assets. In banking, this is also called “financial capacity” and can be used to assess someone’s ability to repay a loan.

ATP is like your customer’s financial bill of health.

Willingness to Pay (WTP)

This is generally defined as the maximum amount a customer is willing to pay for an offering within the context of a given time and place.

(If you want to nerd out, here’s a research paper on the topic that helped inform some of the criteria below.)

That’s kind of a mouthful, and sounds a little complicated. To help make it easier to understand, here are some of the factors that influence WTP. This is not a comprehensive list, but it highlights the variety of factors that go into it.

Customer Perceptions:

- Includes: Perceptions of the features and quality of your offering, trust in the value of your brand. It also includes perceptions of fairness around your price relative to other offerings.

- Example: Paying more for an iPhone because of a belief in Apple’s quality or preference for the device’s design and aesthetics.

Customer Characteristics:

- Includes: Demographic variables (e.g. age, sex, marital status, education, etc.), as well as psychographic and behavioral variables (e.g. interests, opinions, lifestyle, etc.).

- Example: A younger person paying less for an Airbnb home on vacation, and an older person preferring to pay more for the safety and consistency of a standard hotel.

Customer Circumstances:

- Includes: The time and place of the purchase.

- Examples: Paying more for a last minute airline flight, or paying more for sunscreen while at a resort.

Market Environment:

- Includes: Macro trends (e.g. how the economy is doing as a whole) and micro trends (e.g. what happens to be fashionable or popular right now).

- Example: Deciding to buy a VR headset because the technology as a whole has matured and now all your friends are getting them.

Additional Factors to Consider

Here are a few more thoughts to help you with the exercise:

- For customers who have purchased your offering, you’ll need information or insights on their decision process. Conversations you’ve had with your customers, or polls and surveys you’ve conducted can all help inform this.

- When thinking about customers who didn’t purchase your product, or tried it and then left, your info may depend on your business. If you have a service company you may simply know clients that turned down proposals. In other cases you may have insights from customer interviews, surveys, or analytics around your sales funnel to inform this.

- It’s OK to make some approximate guesses to get started. Once you’ve made a first pass you can then discuss it and continue to refine over time or as you discuss with other team members.

- Depending on your business, you may be plotting specific customers or businesses by name or you could look at categories of customers you typically see.

- Willingness to Pay is a fairly complex concept, so you may want to do this exercise a few times adjusting which aspects of WTP you choose to focus on. Looking at different views together may unlock additional insights on which audiences are most valuable to you.

With those definitions in mind, plot your existing or potential customers on the grid below:

Evaluating Your Results

Once you’ve filled in the grid at least once, here are some ideas to consider:

- Section 1: These are your paying customers. They’re willing and able to pay the price you’ve set for your offering. Within that section though, where do you see customers grouping? Are there any concerns with customers falling below the ATP line? Or factors that might push them to the wrong side of the WTP line?

- Section 2: Is there a less expensive version of your offering that could be developed for this audience struggling with ATP? Are you capturing this audience as potential leads that may have the means to purchase later on?

- Section 3: Are you spending too many resources on customers in this area? Can you identify qualities of customers that might be close to crossing over versus those that are very far away on both ATP and WTP?

- Section 4: What are the primary factors keeping these customers from being willing to pay? Can you identify the top concerns or issues they have with your offering? Are there trial offers you could develop to give this audience a less risky entry point to your offering?

As noted above, be sure to note which WTP factors you’re considering as you plot your customers. This will help fuel discussions with team members and serve as a record when revisiting your work down the road.

Tracking these ideas over time should help you attract and convert not just more customers but the right kind of customers for your business.