This article was featured in the December 2022 issue of Foundr Magazine

(click to view the piece)

When we see a strong, memorable brand out in the wild, all we see is the finished product. We have the luxury of consuming the messaging, design, and value proposition without any consideration for the work that went into developing them.

This makes the process of building a brand appear dangerously simple.

It’s a bit like seeing the solution to a puzzle before you attempt to solve it. It sparks confidence that surely you could have arrived at the same result. In retrospect, it’s obvious, right?

So when it comes time for business leaders to develop their own brand, that overconfidence can push them to try and jump straight to an end solution. They try to pluck the perfect message, position, or design right out of thin air…or maybe through a quick brainstorming session.

Unfortunately your brand’s puzzle doesn’t come with a magical answer key. Instead there’s just a big list of questions:

- Who are our ideal customers?

- What do those customers value in a solution?

- When do they need a solution like this?

- Why are they motivated to buy?

- How does our brand fit in the market?

To tackle this puzzle you need a structured approach. You need to understand how everything from your brand’s purpose, to positioning, to messaging all fit together.

And you also need fuel to inform that strategy.

This is where branding research comes in.

Branding research provides that deep understanding of your customers and market through data and insights.

Research helps you understand how your customers think and why they buy. Research helps you understand the market and where you fit into it.

These are the necessary ingredients to make your own strong, memorable brand.

Map & Fire did a survey on how business leaders use research to guide their brands.

84% of the business leaders we polled had done some kind of research in the past 12 months.

What impact did that research have for their business?

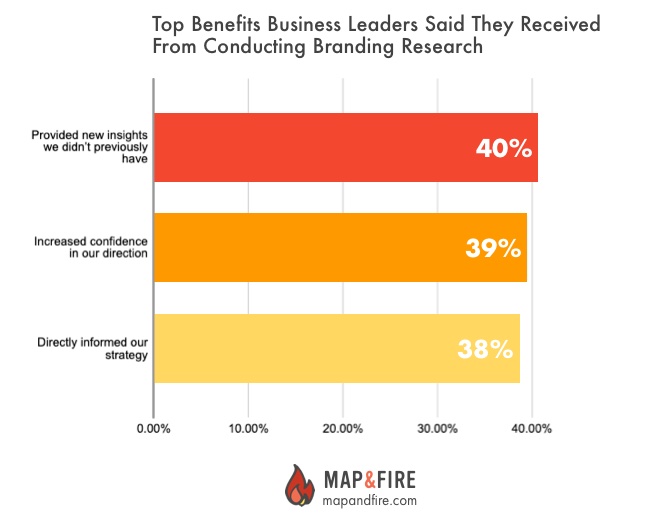

The top 3 benefits they reported receiving:

- Provided new insights we didn’t previously have (40%)

- Increased confidence in our direction (39%)

- Directly informed our strategy (38%)

That’s what it’s all about. Creating clarity around your brand strategy to improve growth.

Here’s how to apply it to your own brand.

What are the main types of branding research?

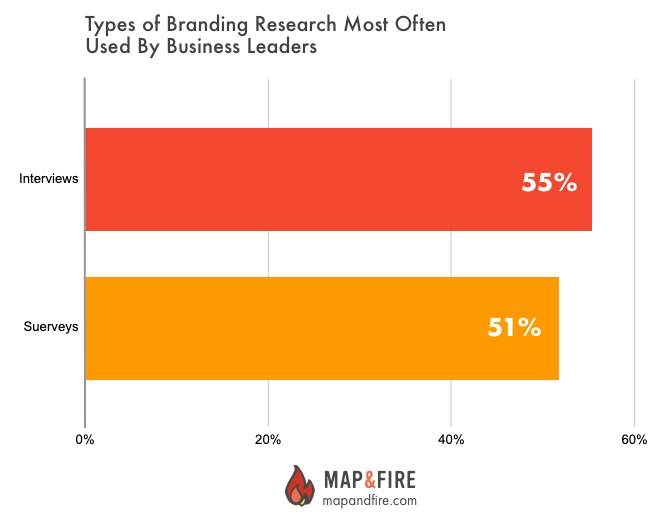

For the business leaders in our survey, the two types of research most utilized were:

- Interviews (55%)

- Surveys (51%)

This aligns with how Map & Fire operates as well. We view surveys and interviews as the best 1-2 combination to gain valuable data. Here are some reasons why.

Customer Interviews: Strengths and Weaknesses

The key strength of the interview format is that it provides a way to dig deep into the experiences and beliefs of customers. Interviews also provide a layer of data around the language and emotion people use when discussing their challenges and motivations.

This is information that doesn’t come through in a survey.

The weaknesses are that interviews can be time consuming to organize and conduct. Also, with a limited number of participants it can be easy to put too much weight on individual responses. Starting with at least 5 interviews helps ensure some healthy diversity around responses.

In Map & Fire’s work we focus on structured customer interviews. This involves developing a strategic set of questions to uncover the most relevant information for the brand.

Using a structured, consistent format makes it possible to uncover trends across interviews.

Some brands also use unstructured interviews as an informal way to collect feedback. The issue is that the lack of consistency leads to scattered results making it difficult to draw useful conclusions.

Customer Surveys: Strengths and Weaknesses

Surveys provide a different yet complementary type of customer data. While interviews allow a brand to go deep and uncover qualitative nuances with customers, surveys allow the brand to explore wider, quantitative trends.

The key strengths of the survey format is that it allows a brand to gather large amounts of structured data in a short amount of time. While the time to conduct interviews increases with the number of participants, a survey can go out to hundreds or thousands of people at once.

Leveraging that volume of responses allows a brand to see customer trends with more accuracy.

The main weakness is that you’re constrained by the format of the questions.

Predefined survey questions don’t provide the flexibility to dig deeper on a specific response like you might in an interview.

There are also best practice limitations around survey length.

To encourage participation and maintain thoughtful responses, surveys are generally kept short. General guidelines are to stick to a length of around 10 minutes or less to complete and fewer than 15-25 questions.

Focus Groups: Strengths and Weaknesses

Another type of branding research that we saw used in the survey we ran were focus groups. About 25% of business leaders said they had used focus groups in the past 12 months.

Focus groups typically function with a single moderator who leads a small group of around 6-12 participants through a series of questions.

While this can be an efficient way to get qualitative feedback, the focus group format has a few inherent challenges.

Because the group consists of strangers, strong personalities have a tendency to dominate the room. People who are naturally reserved may not be as open about their thoughts and feelings in a group setting.

There’s also a danger of “group think”. This is where ideas get presented in the moment that shape people’s opinions or create subconscious pressure to go along with the majority.

These factors can all impact the usefulness and validity of the data that’s collected.

Market and Competitive Research

Another key form of branding research is examining the competitive landscape. This is a critical step in any brand strategy process as it allows you to consider who your competitors are and how your brand compares to them.

This process of comparing and contrasting with the competition provides the data you need to craft a strong position for your brand.

Again, like interviews and surveys, the key to effective market research is to have structure around how you analyze the data. Without a consistent format, it’s nearly impossible to extract meaningful trends.

How do you conduct branding research?

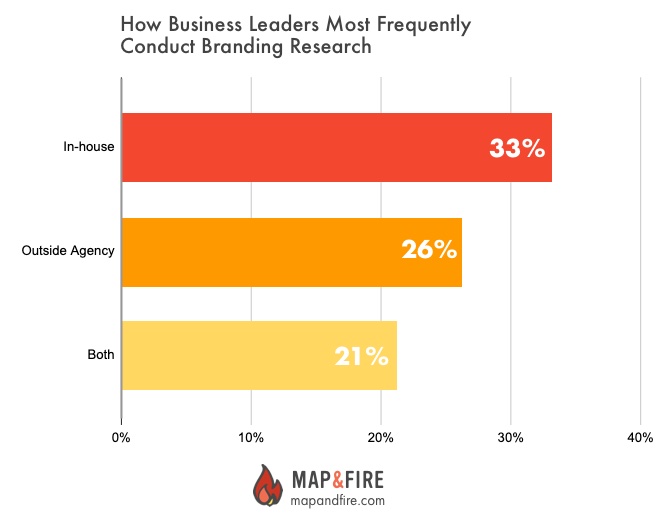

In our business leader survey, we asked how they conducted their branding research over the last 12 months:

- In-house (33%)

- Outside agency (26%)

- Both (21%)

In other words, either the brand did it themselves, they hired a team to help, or did some combination of the two.

Again, there are strengths and weaknesses with each approach.

In-house Research: Strengths and Weaknesses

If a brand has people in-house with experience conducting research, this can be a great way to collect data and insights on a regular basis.

There’s also an inherent level of knowledge about the brand and the market they’re in that can help focus the research on areas that are the most valuable.

The weaknesses are that living and breathing a business every day creates inherent biases for team members. Even when trying to stay objective, past experiences are bound to influence people’s thinking.

If you’re a smaller business it’s also less likely that you’ll have someone on staff that has extensive experience in conducting research. This may mean that the work is less effective, even if the intentions are all in the right place.

Agency Research: Strengths and Weaknesses

If you don’t have resources in-house, hiring an agency can be a great way to access branding research insights.

An outside agency can bring a level of experience and structure to the work that only comes through repetition. This helps ensure both efficiency and accuracy in the work.

There’s also value in using resources with an objective, outside perspective. They don’t have the baggage of internal pressures or established beliefs – their goal is strictly to gather accurate results.

The most obvious challenges with bringing in an agency are cost and time. But when leaders understand how this work impacts the brand’s long term success and growth, it’s easy to justify that investment.

In our survey, we asked business leaders which factors most prevent them from using customer research: cost, time, expertise.

For the business leaders who understood their customers the best, the most common response (43%) was ”Nothing – we use research whenever it’s necessary”.

Get started with your branding research today

Successful business leaders understand the value of research. In our survey, 74% said that research was either Extremely or Very Valuable in aligning their brand with the needs and beliefs of their customers.

Research also doesn’t have to be a massive time commitment.

67% said they would expect to complete a research engagement of a survey and interviews in under 1 month.

That aligns with how we approach research at Map & Fire where we can gather foundational insights within weeks.

When compared to the potential of facing years of misalignment and limited growth, a few weeks is definitely a worthwhile investment.

By taking the time to conduct branding research, you’ll have the data and insights to deeply understand your brand’s strategic puzzle pieces. That’s the recipe for building a strong brand that customers remember.

Build A Brand Based On Research

If you’re ready to build stronger connections with your customers, reach out for a free consultation. We’ll help you transform your best business thinking into an actionable, shareable, growth-oriented guide. Click below to learn more about the Brand Guidebook process.