Brand and Marketing Field Guide: Competition

Does your company own a unique strategic position compared to your competitors?

Competition Definitions & Examples

Our Content Is Featured In:

Join 6,538 folks who receive our latest insights and you'll get immediate access to our 10 page brand strategy workbook!

Instantly analyze your brand

Use our new positioning app, SmokeLadder, to see where your B2B brand is strong, weak, and where it can stand out from the competition.

Competition and Strategic Competition*

“Competition” refers to the tug of war over profits that occurs not just between rivals but also between a company and its customers, its suppliers, makers of substitutes, and potential new entrants. “Strategic Competition” refers to positive-sum competition, in which companies win (and achieve superior profitability) by creating unique value for their customers. This is a win-win form of competition because your customers benefit and so do you.

Competitive Set

Your “competitive set” is a group of products and services that fulfill the same important Job to be Done for your Target Customer. It’s crucial to understand that these other products and services may not be “direct competitors” in the sense that you may be used to.

For example, if your company makes video games, then your competitive set isn’t just other video games; it could consist of anything that provides entertainment, distraction, a competitive outlet, and more. In this context, watching Netflix, going to a live sporting event, or even playing with your dog could all fulfill a customer’s job in place of the video game.

Knowing the “job” the product or service fulfills for your customers is the key insight you need in order to correctly define your competitive set — and to avoid getting blindsided by competitors you hadn’t considered.

One last way angle to consider, which may seem obvious but is easy to overlook, are the Current Solutions that your Customers use to satisfy this job.

It’s important to remember that if this job (aka. problem) really exists in the lives of your Customers, they’re satisfying it somehow. It just may not be in an obvious way — and possibly nothing like the solution you’re providing. Like the example above, it’s easy to forget that “playing with a pet” could in fact be a competitor to a video game.

Competitive Landscape

It’s important to remember that chart you define of your competition is just one possible view of your competitive landscape. There will always be several ways to map your competitive landscape based on different Competitive Sets and different combinations of Jobs and Elements of Value.

The insights we draw from a given competitive landscape will depend on the accuracy of the Customer Job and Elements used to define it. As you learn more about your Customers you’ll gather more data, validate (or invalidate) your assumptions, refine your understanding of your competition, and improve the accuracy of your competitive landscape map.

Read Our Article On Competitive Landscapes:

How To Find Your Brand’s Position With A Competitive Landscape Map

Competitive Position

As part of your brand positioning strategy, the Competitive Landscape map you create shows how your company and your competitors fare at satisfying your target Customer’s Job and Elements of Value.

The best position on the map is in the upper right quadrant: that’s where the Elements of Value of your Target Customer’s most important Job are satisfied at a high level. Conversely, the bottom left quadrant is where those Elements are not satisfied well.

Of course we hope that your company is located in the upper-right quadrant, in a cozy, competition-free zone.

In general, most companies tend to cluster around common themes, such as: satisfying one category of Elements well (e.g. Functional) and the other category poorly (an extreme along the X or Y axis), being mediocre at satisfying both categories of Elements (middle of the map), or satisfying both categories of Elements poorly (lower left).

Read our article on Competitive Position:

Strategy Canvas

A method we use for visualizing how well you satisfy your most important Job to Be Done compared to the competition is the “strategy canvas” popularized in the book Blue Ocean Strategy.

The strategy canvas serves two purposes:

- To capture the current state of play in the known market space, which allows you to see the factors that the industry competes on and where the competition currently invests.

- Identify areas valued by your target customers that are currently underserved by your competition, and then to emphasize those areas in your offering.

The horizontal axis on the strategy canvas captures the range of factors that your industry competes on and invests in, while the vertical axis captures the offering level that buyers receive across all of these key competing factors.

The value curve is the basic component of the strategy canvas. It’s a graphic depiction of a company’s relative performance across its industry’s factors of competition.

A strong value curve has focus (i.e. strong investment in your most important factors), and divergence (i.e. clear separation on factors from competitors).

This information can then be used to construct a Value Proposition (Blue Ocean Strategy refers to this Value Proposition as a “compelling tagline” in their literature) for your customers and team.

NOTE: Traditionally, the strategy canvas is used to focus on comparing the more concrete features of competing products and services. However, we believe it’s important to first examine the Elements of Value because these are even more fundamental to understanding the experience of your Customers.

Use our Google Sheet Template for creating a Strategy Canvas:

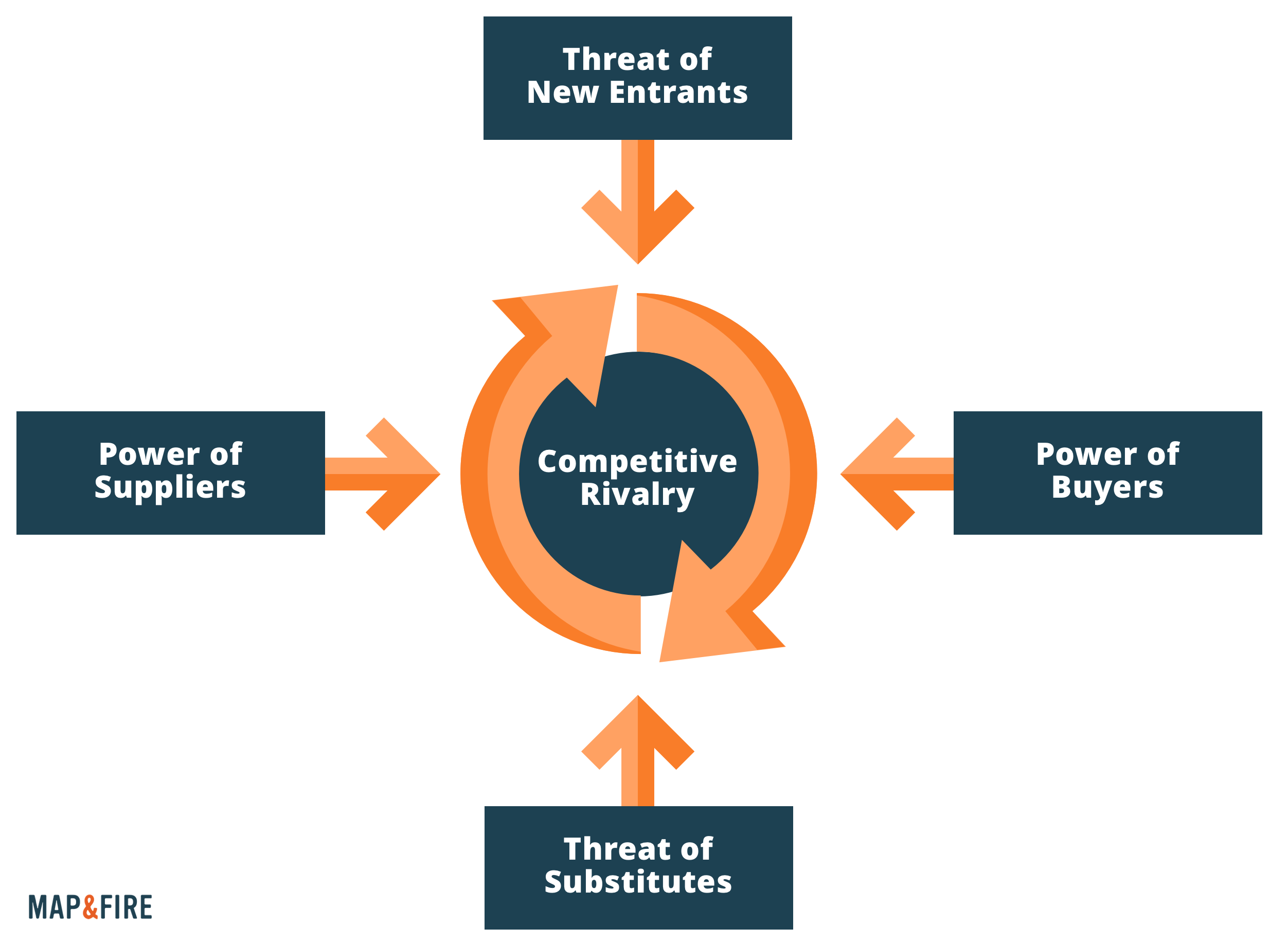

The Five Forces of Competition*

The Five Forces of Competition, as defined by Strategist and Economist Michael Porter, are the universal factors that define the structure of a particular industry. While the most basic idea of competition focuses on direct competition between rivals (i.e. Coke vs. Pepsi, Apple vs. Android), the reality is competition isn’t just about winning a sale over your rivals; it’s about competing for profits.

When you think about competition as it relates to profitability, your perspective quickly expands to include any entity that’s seeking to capture value around your offering. Your customers (aka. buyers) always want more for less. Your suppliers want to be paid more and deliver less. The threat of new entrants to the market limit how much you can charge. An endless parade of substitutes for your offering force you to maximize the value you can provide. And then, of course, there are your direct rivals who are looking to gain any advantage possible over you or force you into price and feature wars.

The five forces are often visualized in a diagram like this:

While this may sound a little scary, the truth is these forces exist whether you’re paying attention to them or not. So your best form of security is to face them head on and understand their impact. That way you can be sure to focus your attention in the right areas and strengthen your position against them. So let’s go through them, one by one, right now.

5 Forces: Threat of New Entrants*

The hurdles a new entrant would have to surmount in order to enter an industry. The easier it is for new companies to enter your space, the more difficult it may be for your company to maintain long term profitability.

If this is a risk, you’ll want to be extremely mindful of the competitive market and think about ways to further strengthen your unique position with customers to avoid ease of switching.

New Entrant Factors

- What’s the threat of new businesses starting in this sector?

- How easy is it to start up in this business?

- Is it possible to start up with little financial commitment?

- Can a business easily start without needing to adhere to specific rules and regulations?

- How easy is it for one of your customers to switch to a comparable solution?

Additional Considerations:

- Who are some recent entrants in your space? How are they similar or different from you?

5 Forces: Threat of Substitutes*

Substitutes represent offerings that satisfy the important jobs of your customers in a different way. For example, smartphones now act as substitutes for wristwatches for many people.

The threat of substitutes are one factor in how you should think about the price of your offering, in that pushing your price too high may encourage customers to seek substitutes — or question the importance of having a solution at all. Substitutes can come from unexpected places, so it’s critical to think about the jobs your customers are looking to satisfy separate from your particular offering or features.

Substitute Factors

- Could customers satisfy their needs in a fundamentally different way, or simply go without?

- How easy is it to find an alternative to this product or service?

- How easy is it to outsource or automate a similar solution?

- Is there little variance between potential solutions?

- Is the cost of your offering often a prohibitive factor for your target customer?

Additional Considerations:

- What have you seen from your customers as the most common substitution for your product or service?

5 Forces: Power of Suppliers*

Suppliers can be thought of covering every input required to create your offering — including access to employees. Powerful suppliers are able to leverage their position to charge higher prices or dictate terms of agreements in their favor.

The stronger their position, the more you’ll be forced to make compromises around the features and price benefits you can offer your customers — i.e. the value you provide. Analyzing supplier relationships and seeking ways to reduce those dependencies can be a powerful differentiator for your company.

Supplier Factors

- How limited are the number of suppliers?

- Is price in your sector primarily dictated by only a few suppliers?

- How difficult is it to switch from one supplier to another?

- Do suppliers hold most of the power to dictate terms of agreements?

- Are you affected by unions or organizations that dictate employee wages or benefits?

Additional Considerations:

- What are the cost factors to switch from a key supplier to an alternative?

5 Forces: Power of Buyers*

Just as you’re seeking to capture value for your company, your buyers (aka. customers) are seeking to capture as much value as they can for themselves. This is expressed by seeking out solutions for their jobs that best satisfy their priorities (Price, Quality, Convenience).

High buyer power creates habits like bargain shopping where buyers balance out what will satisfy their needs the best at the lowest possible cost. When buyers make decisions strictly based on price due to undifferentiated competitive offerings your company and your industry as a whole suffers. Seeking ways to make your offering unique and ingraining customers in your specific ecosystem is a big part of reducing that power.

Buyer Factors

- How limited are the number of buyers?

- Can buyers force prices down due to easy access to comparable solutions?

- Can buyers force solutions to add value / features due to easy access to comparable solutions?

- How easy is it for customers to switch between solutions?

- Do buyers hold most of the power to dictate terms of agreements?

Additional Considerations:

- What are some unique ways you meet the needs of your customers that would reduce their power?

5 Forces: Rivalry Among Direct Competitors*

This is the head to head competition between companies with similar offerings. It can have many negative side effects for companies including artificial lowering of prices, inflated services and features, and increased overhead for marketing.

This is damaging for the companies involved and ultimately for customers as they end up with bloated, over-serving offerings, and risk losing choices as companies become unsustainable. If you find yourself in this type of environment it warrants a serious look at how you can pivot your offering to create clear separation from competitors.

Competitive Rivalry Factors

- Are the offerings of your company and competitors largely undifferentiated?

- Are there frequent / ongoing price wars, or escalation of features, or other battles to provide value for the same price?

- Are there a high volume of competitors in your sector resulting in commoditization of your offering?

- Does your industry grow slowly resulting in the same players competing for long periods of time?

- Is your offering highly perishable increasing the need to compete around price? (i.e. this can apply to goods like fruit, fashion, or tech, as well as hotel rooms, airline seats, or simply your time in a service industry)

Additional Considerations:

What are the top customer jobs around which your industry competes?

* Definitions based on or influenced by the book Understanding Michael Porter by Joan Magretta